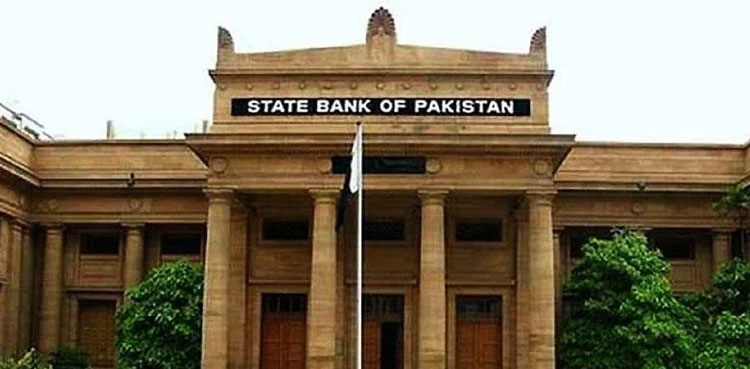

KARACHI: Pakistan has achieved a major milestone in its financial journey, recording a present account surplus of US$682 million throughout the first seven months of the present fiscal 12 months (2024-25), ARY Information reported citing the State Financial institution of Pakistan (SBP).

In accordance with the central financial institution, the present account surplus of US$682 million from July 2024 to January 205 marks a considerable enchancment from the identical interval final 12 months, which noticed a deficit of over $1.8 billion.

In accordance with the SBP, in January 2025, the present account deficit stood at $420 million, in comparison with a surplus of $474 million in December 2024.

Regardless of the deficit in January, the nation’s imports elevated by 11 % to $5.45 billion, whereas exports declined by 4 % to $2.94 billion. The commerce deficit for January surged by 37 % to $2.51 billion, whereas the deficit in commerce, providers, and earnings elevated by 26 % to $3.56 billion.

Learn Extra: Pakistan earns $1.8b from IT providers’ export

In the meantime, the Pakistan Inventory Change (PSX) witnessed a bullish pattern because the KSE-100 index gained 1344 factors on Monday.

The 100-Index of the Pakistan Inventory Change (PSX) rotated to a bullish pattern on Tuesday, gaining 1,344.95 factors, a optimistic change of 1.20 %, closing at 113,088.48 factors as in comparison with 111,743.53 factors on the final buying and selling day.

A complete of 545 million shares had been traded throughout the day as in comparison with 511.194 million shares the earlier buying and selling day, whereas the value of shares stood at Rs20.741 billion in opposition to Rs19.635 billion on the final buying and selling day.

Analysts at Topline Securities mentioned that the rise was primarily pushed by LUCK, ENGRO, OGDC, EFERT, and PPL, which collectively contributed 608 factors to the general achieve.

They mentioned, “The KSE 100 index skilled a pullback and ended on a optimistic word. The index reached a excessive of 113,253 factors, dipped to an intraday low of 111,642 factors, and closed at 113,088 factors, gaining 1,345 factors or 1.20%”.